Annual General Meeting of Shareholders in Loomis AB (publ)

The shareholders of Loomis AB are hereby invited to attend the Annual General Meeting (”AGM”) to be held at 5 p.m. CEST on Thursday 3 May 2018 in Pelarsalen at City Conference Centre, Norra Latin, entrance Barnhusgatan 7B, Stockholm. Registration for the AGM begins at 4 p.m. CET.

A. Notice of Attendance

Shareholders who wish to attend the AGM must:

(i) be recorded in the share register maintained by Euroclear Sweden AB, made as of Thursday 26 April 2018, and

(ii) notify the company of their intention to participate in the AGM at the address Loomis AB, ”AGM”, c/o Euroclear Sweden AB, P.O. Box 191, SE-101 23 Stockholm, by telephone + 46 8 402 90 72 or via the company website www.loomis.com by Thursday 26 April 2018, at the latest, preferably before 4 p.m. When registering to attend, the shareholder must provide name, personal identity number (corporate identity number), address and telephone number. Proxy forms are available on the company website www.loomis.com and will be sent to shareholders who contact the company and provide their address. Any proxy or representative of a legal person must submit an authorization document prior to the AGM. The authorization document must not be more than one year old, unless a longer period of validity is stated in the authorization document (maximum five years). As confirmation of the registration, Loomis AB will send an entry card to be presented when signing in for the AGM.

In order to participate in the proceedings of the AGM, shareholders holding nominee-registered shares must submit a request to their bank or broker to have their shares temporarily registered in the shareholders own name with Euroclear Sweden AB. Such registration must be completed by Thursday 26 April 2018 and the bank or broker should therefore be notified well in advance of this date.

B. Agenda

Proposal for Agenda

- Opening of the Meeting.

- Election of Chairman of the Meeting.

- Preparation and approval of the voting list.

- Approval of the agenda.

- Election of one or two person(s) to approve the minutes.

- Determination of compliance with the rules of convocation.

- The President’s report.

- Presentation of

-

the Annual Report and the Auditor’s Report and the Consolidated Financial Statements and the Group Auditor’s Report,

-

the statement by the auditor on the compliance with the guidelines for remuneration to Group Management applicable since the last AGM, and

-

the Board’s proposal for appropriation of the company’s profit and the Board’s motivated statement thereon.

-

- Resolutions regarding

-

adoption of the Statement of Income and the Balance Sheet and the Consolidated Statement of Income and the Consolidated Balance Sheet as per 31 December 2017,

-

appropriation of the company’s profit according to the adopted Balance Sheet,

-

record date for dividend, and

-

discharge of the Board of Directors and the President from liability for the financial year 2017.

-

- Determination of the number of Board members.

- Determination of fees to Board members and auditor.

- Election of Board members and auditor.

- Resolution on principles for the appointment of the Nomination Committee.

- Determination of guidelines for remuneration to Group Management.

- Resolution on the implementation of an incentive scheme, including hedging measures through the conclusion of a share swap agreement.

- Closing of the Meeting.

Election of Chairman of the Meeting (item 2 on the agenda)

The Nomination Committee elected by the AGM 2017 consisting of Jan Svensson (Investment AB Latour etc.), Mikael Ekdahl (Melker Schörling AB), Marianne Nilsson (Swedbank Robur fonder), Johan Strandberg (SEB Fonder) and Henrik Didner (Didner & Gerge Fonder) has proposed that Alf Göransson, Chairman of the Board, be elected Chairman of the AGM 2018.

Proposal for Dividend (items 9 (b) and (c) on the agenda)

The Board proposes that a dividend of SEK 9.00 per share be declared. As record date for the dividend, the Board proposes 7 May 2018. If the AGM so resolves, the dividend is expected to be distributed by Euroclear Sweden AB starting 11 May 2018.

Proposals for Election of Board Members and Resolution Regarding Fees (items 10-12 on the agenda)

At the AGM 2018 the Nomination Committee will, in connection with the election of Board members and resolution regarding fees, present and motivate the below proposals. The reasoned statement of the Nomination Committee is also available at the company website, www.loomis.com.

The Nomination Committee has proposed the following.

The number of Board members shall be six, with no deputy members. The Nomination Committee proposes re-election of the Board members Alf Göransson, Jan Svensson, Patrik Andersson, Ingrid Bonde, Cecilia Daun Wennborg and Gun Nilsson for the period up to and including the AGM 2019, with Alf Göransson as Chairman of the Board.

Fees to the Board members for the period up to and including the AGM 2019 shall amount to SEK 3,000,000 in total (including fees for committee work) to be distributed among the Board members as follows: the Chairman of the Board shall receive SEK 850,000 and each of the other Board members, except for the President, shall receive SEK 400,000. The remuneration for committee work shall be unchanged and the Chairman of the Audit Committee shall receive SEK 200,000, the Chairman of the Remuneration Committee shall receive SEK 100,000, the members of the Audit Committee each SEK 100,000 and the members of the Remuneration Committee each SEK 50,000.

The accounting firm Deloitte AB is proposed for new election for a period of mandate of one year, in accordance with the recommendation of the Audit Committee. In the event that Deloitte AB is elected, the accounting firm has informed that the authorized public accountant Peter Ekberg will be auditor in charge.

The auditor’s fee is proposed to be paid according to agreement.

Proposal for resolution on instructions for the appointment of the Nomination Committee (item 13 on the agenda)

The Nomination Committee proposes that the following instructions for appointment of Nomination Committee and the Nomination Committee’s assignment are resolved by the Annual General Meeting in 2018.

The Nomination Committee shall be composed of representatives of the five largest shareholders in terms of voting rights registered in the shareholders’ register maintained by Euroclear Sweden AB as of August 31 the year before the Annual General Meeting.1 The Chairman of the Board shall convene the Nomination Committee to its first meeting and shall also be co-opted to the Nomination Committee. Should a shareholder decline to participate in the Nomination Committee, a representative from the largest shareholder in turn shall be appointed. The composition of the Nomination Committee for the Annual General Meeting shall be publicly announced no later than six months prior to each Annual General Meeting.

In the event one or more shareholders who appointed members of the Nomination Committee, earlier than three months prior to the Annual General Meeting, no longer are among the five largest shareholders in terms of voting rights, the members appointed by such shareholders shall resign and the shareholder or shareholders who has become one of the five largest shareholders in terms of voting rights shall be entitled to appoint their representatives. If there are only marginal changes in the number of votes held or if the change occurs later than three months prior to the Annual General Meeting, no changes shall be made in the composition of the Nomination Committee unless there are special circumstances. If a member resigns from the Nomination Committee before the work is completed and the Nomination Committee finds it suitable, a substitute shall be appointed. Such a substitute shall be appointed from the same shareholder or, if that shareholder no longer is among the largest shareholders in terms of voting rights, from the largest shareholder next in line. A change in the composition of the Nomination Committee shall immediately be publicly announced.

The term of office for the Nomination Committee runs until the next composition of the Nomination Committee has been announced. No remuneration shall be paid out to the members of the Nomination Committee. Potential necessary expenses for the work of the Nomination Committee shall be paid by the company.

The Nomination Committee shall prepare proposals regarding the election of Chairman of the General Meeting, members of the Board of Directors, Chairman of the Board, auditor, fees for the members of the Board including division between the Chairman and the other Board members, as well as fees for committee work, fees to the company’s auditor and changes of the instructions for the Nomination Committee.

This instruction shall apply until further notice.

Proposal for Guidelines for Remuneration to Group Management (item 14 on the agenda)

The Board’s proposal for guidelines for salary and other remuneration to Group Management principally entails that the total remuneration are to be competitive and in accordance with market conditions. The benefits are to consist of a fixed salary, a possible variable remuneration, and other customary benefits and pension. The variable remuneration is to have an upper limit and be related to the fixed salary. The variable remuneration is to be based on the outcome in relation to set targets and be in line with the interests of the shareholders. Pension benefits are to be fee-based and pension rights are to be applicable as from the age of 65, at the earliest. For members of Group Management that are not subject to any collective agreement (ITP-plan), variable remuneration shall not be pension qualifying.

The Board has the right to deviate from the guidelines in individual cases if there are particular grounds for such deviation.

Proposal for a resolution on the implementation of an incentive scheme, including hedging measures through the conclusion of a share swap agreement (item 15 on the agenda)

Background and Motives

Loomis AB presently has a recurring incentive scheme resolved by the AGM 2017. In the long run, this incentive scheme will make it possible for approximately 350 of Loomis’ key-employees to become shareholders of Loomis which is important in order to further strengthen the employee ownership in Loomis’ future success and development. It is the opinion of the Board that the incentive scheme (which has been applied since 2010) has been appropriate and contributed to the creation of joint goals for key-employees and the shareholders. The Board, therefore, proposes that the AGM 2018 resolve on a new incentive scheme with terms and conditions which in essence corresponds with the terms and conditions of the incentive schemes adopted by the AGMs 2010-2017.

The proposal principally entails that 1/3 of any annual bonus earned may be paid in the form of class B shares in Loomis with delayed payment and subject to continued employment with Loomis. It is the assessment of the Board that the proposed incentive scheme will retain the group’s attractiveness as an employer.

(A) Implementation of an Incentive Scheme

The Board proposes that the AGM resolves on a share and cash bonus incentive scheme (the “Incentive Scheme”), in accordance with the following main principles. Approximately 350 employees will participate in the Incentive Scheme and thereby be entitled to receive a part of the yearly bonus in the form of shares in Loomis, provided that certain predetermined and measurable performance criteria are met. The principles already applicable under the existing incentive scheme, within the scope of the principles on remuneration to Group Management adopted by the AGM, will continue to apply. The existing principles relate to result in improvements and are set as close to the local business as possible and aim for long term profitability of the group. For parent company employees the performance-based targets are relating to earnings per share (“EPS”) for Loomis compared with previous year. For other participants in the Incentive Scheme, the performance-based targets are relating to improvement of profits of the applicable profit centre. The performance-based targets vary depending on in which part of the business the employee works, but are principally based on an annual improvement of EPS or EBITA2 within the employee’s area of responsibility. Provided that applicable performance criteria are met, the annual bonus will be determined at the outset of 2019 and be payable by (i) 2/3 in cash at the outset of 2019 and (ii) 1/3 in class B shares (the “Bonus Shares”) at the outset of 2020. The number of Bonus Shares to which each participant will be entitled shall be determined by the ratio between the available bonus and the share price at the time of determination of the bonus. Distribution of Bonus Shares in accordance with (ii) is subject to the following two conditions: (1) if the total accrued bonus amounts to less than EUR 4200, the whole bonus will be paid out in cash in accordance with (i) above, and (2) the employee must remain employed by Loomis as of the last day of February 2020, except where an employee has left his/her employment due to retirement, death or long-term disability, in which case the employee shall have a continued right to receive Bonus Shares.

Prior to the distribution of Bonus Shares, the employee will not be awarded any shareholder rights (e.g. voting rights or rights to dividend) connected to the Bonus Shares. At distribution of the Bonus Shares, the employee shall, however, be entitled to additional shares up to a value corresponding to any dividend paid as regards the Bonus Shares (based on the value of the share at the time of distribution) during the period from payment of the cash bonus until the distribution of the Bonus Shares. The Board shall be entitled to resolve on a reduction of the distribution of Bonus Shares if distribution in accordance with the above conditions – considering Loomis’ result and financial position, other circumstances regarding the group’s development, and the conditions on the stock market – would be clearly unreasonable. Participation in the Incentive Scheme presumes that such participation is lawful and that such participation in Loomis’ opinion can take place with reasonable administrative costs and economic efforts. The Board shall however be entitled to implement an alternative incentive solution for employees in such countries where participation in the Incentive Scheme is not advisable, which alternative solution shall, as far as practically possible, correspond to the terms of the Incentive Scheme.

The Board shall be responsible for the particulars and the handling of the Incentive Scheme within the frame of the above principal guidelines and shall also be entitled to make such minor adjustments which may prove necessary due to legal or administrative circumstances.

(B) Incentive Scheme Costs and Hedging Measures Based on a Share Swap Agreement

Except as stated below regarding the share swap agreement, the fact that a part of the bonus is made share related does not entail any material costs in addition to costs, such as payroll expenses and social security payments, which would follow if the Incentive Scheme would have been implemented as a completely cash-settled program.

The financial exposure of the Incentive Scheme is proposed to be hedged by Loomis entering into a share swap agreement with a third party, whereby the third party in its own name shall acquire and transfer shares in the company to employees participating in the scheme. The conclusion of a swap agreement is estimated to involve additional costs of approximately SEK 350,000.

Total Number of Shares and Effects on Important Key Ratios

The hedging measure above will have no effect on the profit per share except for the increased costs that the Incentive Scheme may entail.

The Incentive Scheme is estimated to comprise maximum 135,000 shares (based on the maximum outcome adjusted to the present number of entitled employees and an estimated share price of SEK 300) corresponding to 0.18 percent of the total number of outstanding shares and 0.13 percent of the total number of votes in Loomis.

Voting Majority

The resolutions according to (A) and (B) above shall be adopted as one resolution. In order to be valid, this resolution must be supported by shareholders representing more than half of the votes cast, or, in case of equal voting, by the opinion supported by the Chairman of the AGM.

C. Available Documentation ETC.

The following documentation will be available at the company and on the company website www.loomis.com as from 12 April 2018, will be available at the AGM and copies of the documentation will also be sent to the shareholders who so request: (i) the accounting material and the Auditor’s Report, including the Board’s proposal for guidelines for remuneration to Group Management, (ii) the statement by the auditor on the compliance of the guidelines for remuneration to Group Management applicable since the last AGM, (iii) the complete proposal of the Board with respect to appropriation of profit and the Board’s motivated statement thereon, (iv) the Nomination Committee’s complete proposal for resolution on instructions for the appointment of the Nomination Committee and (v) the complete proposal of the Board with respect to the Incentive Scheme.

D. NUMBER OF SHARES AND VOTES IN THE COMPANY

At the time of issue of this notice, the total number of shares in the company amounts to 75,279,829, of which 3,428,520 class A shares and 71,851,309 class B shares. Class A shares entitle to ten votes. Class B shares entitle to one vote. The total number of votes in the company amounts to 106,136,509. The company holds 53,797 treasury shares.

E. INFORMATION AT THE AGM

The Board of Directors and the President shall, if any shareholder so requests, and if the Board of Directors considers that this can be done without significant harm for the company, give information on circumstances that can affect the judgment of an item on the agenda, circumstances that can affect the assessment of the financial situation of the company or its subsidiaries and the company’s relationship with another group company.

Stockholm in March 2018

The Board

Loomis AB (publ)

- The shareholding statistics to be used shall be sorted by voting power (grouped by owners) and include the 25 largest direct registered shareholders in Sweden, i.e. shareholders with an account with Euroclear Sweden AB in their own name or shareholders holding a custody account with a nominee that have reported the identity of the shareholder to Euroclear Sweden AB.

- Earnings before interest, taxes, amortization of acquisition-related intangible fixed assets, acquisition-related costs and revenue, and items affecting comparability.

Company information

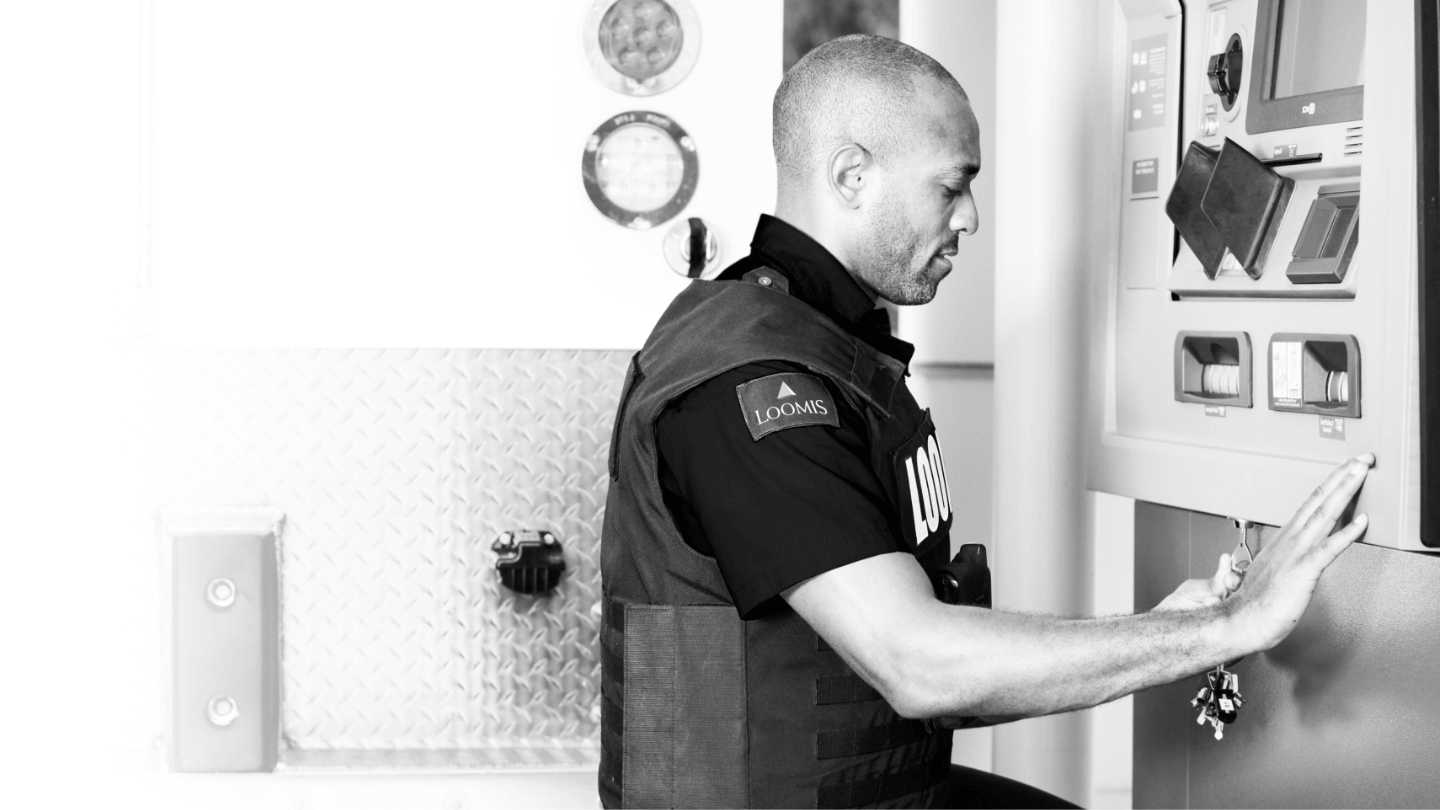

Loomis offers safe and effective comprehensive solutions for the distribution, handling, storage, and recycling of cash and other valuables. Loomis customers are banks, retailers, and other companies. Loomis operates through an international network of more than 400 branches in more than 20 countries. Loomis employs around 24,000 people and had revenue in 2017 of SEK 17.2 billion. Loomis is listed on Nasdaq Stockholm Large-Cap list.

Find out how Loomis can help you cut costs while improving security and accuracy.

Contact Us