How Higher Interest Rates Will Impact Retailers and Restaurants

Currently, inflation is at 8.6 percent, the highest it has been since 1981. However, the Federal Reserve raised interest rates by three-quarters of a percentage point in mid-June in an aggressive attempt to combat the rapid and persistent inflation. This rate increase is the central bank’s largest increase since 1994, and Fed Chair Jerome Powell is showing no signs of slowing down and is expecting another similar rate hike in July. But what does this mean for retailers? As rates go up, it will make expanding a business more expensive and potentially increase unemployment by another half percentage point, which could put additional strain on labor resources. In this insight, we will break down the upcoming trends we are likely to see in the retail industry as rates and inflation continue to increase.

1. Higher supply chain costs

This issue is already exasperated by the current supply chain shortages brought on by the pandemic. Increased interest rates and inflation will make it difficult for retailers and restaurants to keep purchasing necessary inventory and supplies at their current rate, which will negatively impact their profit margins and bottom line. Many owners and operators have pushed some of this additional cost onto customers. However, this is not sustainable, and we will see margins compress or sales go down.

2. More financial pressure on small and medium-size businesses

In higher-rate markets, small businesses are some of the first to feel the pressure that we saw at the beginning of the pandemic. A lack of overall buying power makes it more challenging for independent businesses to survive causing many of them to shutter. However, there is an opportunity for smaller businesses or franchisees to sell to larger, well-capitalized franchisees or companies. If cost pressures do not alleviate soon, expect to see smaller businesses and underperforming businesses close their doors or get acquired.

3. Frequency of cash deposits will increase

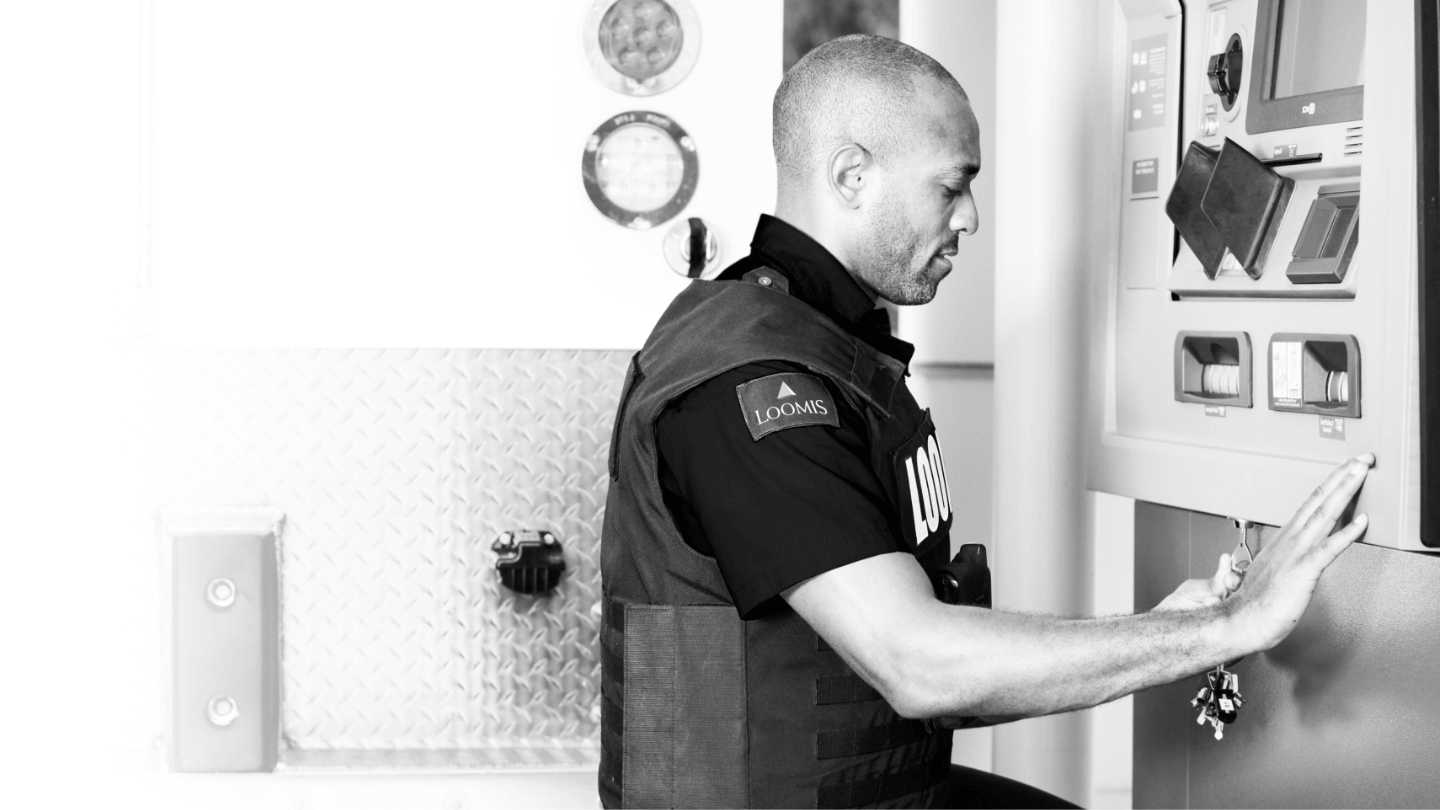

In a low-interest-rate environment, many businesses choose to hold onto deposits for an average of 1-3 days to decrease armored car frequency or trips to the bank. However, in a higher-rate environment, businesses look to make more frequent deposits, typically every business day. This is because operators cannot afford to float money for multiple days at a time. In a higher-rate environment, there are opportunities for businesses to gain higher yields on interest income investments, or pay down high-interest lines of credit. Reducing the amount of idle cash on hand ensures there is more money in the account to be put to good use. Loomis’s smart safes and recyclers provide operators with accelerated deposit credit which means businesses will receive credit for that deposit the next day without having to physically deposit it in the bank. During this time of higher rates, this benefit is invaluable to businesses looking to capitalize on their cash deposits.

4. Cost of credit will go up

Higher interest rates lead to a higher cost of credit. For retailers and operators, this could lead to less expansion, investment, remodeling, and mergers and acquisitions. Many retailers will have to limit growth and expansion plans during a higher interest rate environment due to the cost of credit. A good example of the impact of the cost of credit is the stress it can often cause between franchisors and franchisees in the restaurant industry. Franchisors may seek to execute brand initiatives such as remodels or rebranding, and franchisees are forced to finance these costs at higher rates.

5. Higher unemployment rate

As previously mentioned, it is expected the unemployment rate will go up by another half a percentage, making the unemployment rate 4.1 percent as we approach 2024. The current labor shortage continues to put a huge strain on retail and restaurant owners and operators. Many have already made adjustments to operate with fewer employees by shortening store hours, changing menu options, and investing in automation for low-value tasks. The higher-rate market will continue to cause staffing challenges for employers, which is why it is more important than ever for owners and operators to evaluate their recruitment and retention strategies.

It is predicted that higher rates will be here to stay, and retailers and restaurants will need to adjust accordingly to minimize any potential impact. This can be done by investing in employees, looking for low-value tasks to automate, evaluating armored car and deposit frequency, and ensuring growth and expansion strategies are being implemented at the right time.

Find out how we can help with your cash management.

Contact Us